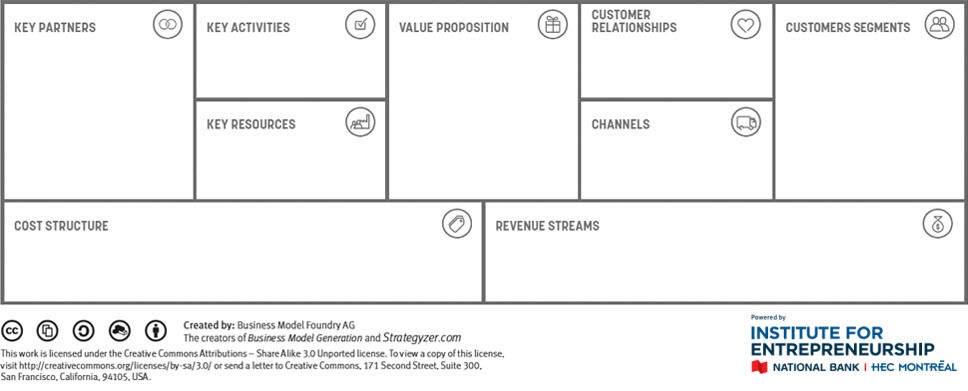

Setting up your business and keeping it profitable will require you

to work with suppliers, subcontractors, distributors and other

partners who are essential to delivering on your value proposition.

Bearing in mind that partnerships come in a variety of different

forms (for example, you might form a strategic alliance with a

competitor or launch a business with one of your suppliers), ask

yourself these questions:

- Who are your most important partners and suppliers?

- Which partners help you carry out activities that you do not

perform in-house?

- Which partners provide you with the

resources that you don't have in-house?

Remember that a good partnership brings many benefits, including

maximizing profits and reducing risks.