Currency hedging

Any company that carries out international transactions is

exposed to risks related to exchange rate variations. That's why it's

important to protect your profit margin with hedging instruments

adapted to your needs.

Main foreign exchange risk solutions

When you issue or receive payment in a foreign currency, the conversion rate may differ from the rate you anticipated when you signed the contract with your client or supplier. Use the right tools to protect your profits.

Forward contract

-

This type of transaction allows you to manage your foreign exchange risk by fixing your conversion rate in advance. This eliminates the uncertainty associated with currency fluctuations.

-

The forward exchange rate reflects the prevailing spot rate, adjusted upwards or downwards by the prevailing forward rates.

-

The maximum term allowed depends on your needs and the credit arrangements made with National Bank.

-

This contract can be settled on a fixed date, or open over a 30-day period (up to 180 days in some cases).

-

You can carry out the transaction online by signing in to online banking for business.

Average-rate forward contracts

This transaction provides the same benefits as the forward and the range forward, but over a longer period; very useful to protect recurring transactions.

- Perform your currency conversions at the spot rate throughout

the period of the contract.

- We calculate the Bank

of Canada's average noon rate for the same period.

- We then make a cash settlement based on the difference

between this average and the rate negotiated on your contract for

the amount covered.

- This settlement offsets the spot rate obtained during the period.

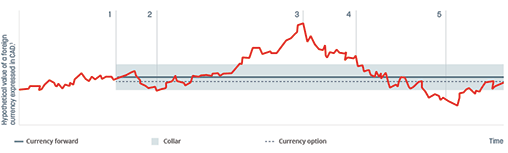

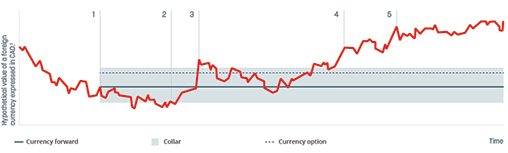

Range forward

-

Negotiate a range in which the exchange rate will be allowed to fluctuate, rather than a single rate. Allows you to benefit from a favourable market variation up to a pre-determined level; if the market rate moves in the wrong direction, the collar will offer you a safety net.

-

Maximum and minimum rates are based on the market rates for the selected dates, as well as the exchange rates you have used in your budget.

-

Maximum term of the collar depends on your business needs and the credit limit authorized.

Other FX solutions

-

Currency swap for businesses with payables and receivables in a single currency, but with different inflow and outflow dates.

-

Cap/floor sales enable you to wait for the market to reach a certain level before implementing a hedging strategy.

-

Participating forwards provide full protection against adverse market movements, while allowing partial participation in favourable market movements.

Currency option

-

A currency option allows you to secure an exchange rate and protect yourself from unfavourable fluctuation while benefiting from favourable ones. This product is very useful when you respond to a call for tenders involving currency risk.

-

The premium you pay for this product depends on a number of factors, including the term, amount, domestic interest rate, current exchange rate and volatility of the exchange rate.

Foreign exchange transactions

Take advantage of our new features to manage your foreign exchange

contracts. On the platform, you can now :

-

Manage foreign exchange transactions

-

Postpone a contract

-

Advance a contract

-

Merge contracts

To learn more, consult our Business help centre.

What is currency risk?

A company is exposed to currency risk when the value of its transactions and investments, and even its viability, is affected by fluctuations in exchange rates. That's why it's so important to be familiar with the right protection options.

The following are fictional examples related to currency risk and currency protection:

To learn more, download our guide, created in partnership with HEC Montréal.

Regulatory information

Foreign exchange disclosures

National Bank of Canada acts as a market participant, as defined in

the FX Global Code (Code), and is committed to conducting its

FX Market activities in a manner consistent with the principles of the

code. We are publishing the following disclosure statement to inform

our clients and counterparties of how we conduct activities on the FX

Market.

FX Disclosure Statement (PDF) – as of February 12, 2018

Disclosure statement on over-the-counter (OTC) derivative transactions

National Bank of Canada wishes to inform you of the regulation governing the trading and reporting of swaps and other OTC derivative instruments in Canada (the “Reporting Regulations”).

Since October 31, 2014, market participants must report their transactions to provincial regulation entities in Quebec, Ontario and Manitoba. Regulation has been extended to all provinces and territories since July 29, 2016. Here is the procedure to obtain an LEI.

Frequently Asked Questions (PDF)

Helpful articles

-

Management buyout: How to identify successors within your company

Management buyout: How to identify successors within your company -

Managing your farm sale or transfer

Managing your farm sale or transfer -

Business transfer: A seven-step guide

Business transfer: A seven-step guide

Helpful services

Are you looking for other solutions to manage your international transactions?