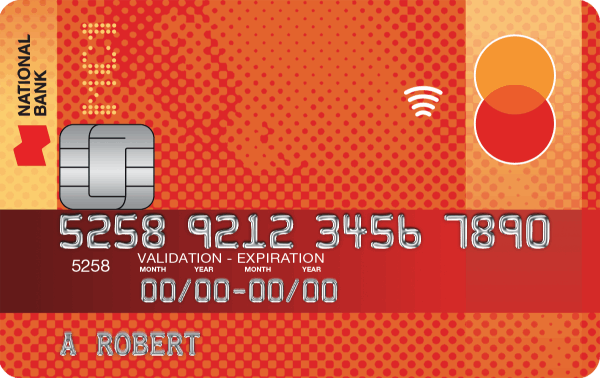

MC1 Mastercard credit card

A simple and efficient credit card

${p1.urlBoiteLogin|link:"Get your card":"btn btnRTE3 modal-token index-p1"}

MC1® Mastercard® credit card at a glance

Access to pre-authorized debits

First steps in credit building

Extended warranties on your purchases1

Annual fee

${p1.productPricing.AF_CRD.productPricingValue | amount:"true"}

Purchase rate

${p1.productPricing.TX_INT.productPricingValue|percent:"true"}

Interest rate (balance transfers and cash advances)2-3

${p1.productPricing.TX_TRF.productPricingValue|percent:"true"}

${p1.urlBoiteLogin|link:"Get your card":"btn btnRTE3 modal-token index-p1"}

Secure online form

Jusqu’à 900 $ en rabais voyage ou jusqu’à 800 $ à investir dans un produit financier annuellement*

Benefits of the National Bank® MC1® Mastercard® credit card

Simple admission terms

No minimum annual income is required

Zero liability protection

No liability for unauthorized transactions4

Purchase protection

Up to 90 days after purchase in case of theft or damage1

Adapted limit

Minimum credit limit of $500 which can be increased under certain conditions5

Enhanced security

Online purchases protected by Mastercard® ID CheckTM

Quick and easy payments

Make contactless payments with Apple Pay® or Google Pay®

Enjoy unique experiences and useful features

Explore the extraordinary with Mastercard® Priceless Cities®

Enjoy priceless experiences with Mastercard® Priceless Cities®! Enjoy beautiful destinations, dining experiences, priority access, and more in your city and the places you visit.

Different features to make life easier

- Double the manufacturer's warranty1 for up to an additional

year.*

- Protect your account with the ability to

block, unblock, or replace your credit card.

- Receive balance alerts, activate travel alerts, and schedule

pre-authorized payments with no annual fee.

* Maximum coverage of $60,000 for the entire term of the account

Get a quick response to your application

Apply online from the comfort of your home and get an answer in minutes.

${p1.urlBoiteLogin|link:"Get your card":"btn btnRTE3 modal-token index-p1"}

Secure online form

Not the right credit card for you?

We’re here for you

Want to apply for the MC1 Mastercard credit card?

Apply online. It’s quick and easy.

${p1.urlBoiteLogin|link:"Get your card":"btn btnRTE3 modal-token index-p1"}

Need personalized advice?

Our advisors are here to answer all of your questions

Need additional assistance?

Find all the answers to your questions in our Help centre.

Little details that matter

${p1.ageMin.lbl} |

${p1.ageMin} |

${p1.statutLeg.lbl} |

${p1.statutLeg} |

Annual fee 1 |

$0 |

Annual fee for additional card |

$0 |

Purchase rate |

${p1.productPricing.TX_INT.productPricingValue|percent:"true"} |

Balance transfer and cash advance rate 1-2 |

${p1.productPricing.TX_TRF.productPricingValue|percent:"true"} |

Minimum credit limit 5 |

${p1.productCriteria.AMTRANGE.criteriaLowerValue | amount:"true"} |

Summary and insurance certificate |

Consult the${p1.guideDistr|link:"Summary":"":"_blank" }[PDF] and the${p1.certif|link:"Insurance Certificate":"":"_blank" }[PDF] |

Zero Liability 5 |

Included |

Purchase protection against theft or damage 4 |

${p1.assuranceAchats} days following the purchase date |

Extended warranty 4 |

${p1.garantieProlong.en} |

Customer service (24/7) |

|

Insurance claim |

|

Lost or stolen card |

|

Chargeback |

To learn more about the terms applicable to your card, read the${p1.urlConvention.en | link:"Credit card Agreement":"":"_blank"}[PDF].

There are two main elements of a joint credit card:

-

The primary cardholder’s name will be the one that appears on

the credit card contract. This person can decide to add up to three

authorized users to their account, as well as remove them at any

time. They must meet all the eligibility criteria to apply for a

credit card.

-

An authorized user has their own card and PIN. However, all

transactions made by that person are charged to the primary

cardholder’s account. An authorized user could be a spouse, a child

aged 16 or older, or a friend. The designated person doesn’t need to

meet all of the eligibility criteria to access their card.

Please remember that the primary cardholder is responsible for

paying any outstanding balances and managing the account. This also

means that they’re the ones who will receive any cashback generated by

the account. If any disagreements or separations occur, the authorized

users and primary cardholder must agree on how to proceed.

The authorized user doesn’t receive a statement and doesn’t have

access to transaction details and account information, including the

credit card limit. However, both cardholders can enjoy the benefits of

their card. They can also change their respective PINs, as well as

cancel or replace their cards.

How do I get a joint credit card?

If you’re applying for a new credit card, answer “Yes” to the “Do

you need an additional card” question in our application form.

If you’d like an additional card for an existing account, fill out our credit card application or call us

at 1-888-622-2783.

Please note that there’s an annual fee for an additional credit

card.

To learn about how we protect your information, consult our Confidentiality Policies.

® MC1 and Mastercard are registered trademarks, and the circles design is a trademark of Mastercard International Incorporated. Authorized user: National Bank.

TM MYCREDIT is a trademark of National Bank of Canada.

® Priceless Cities is a registered trademark of Mastercard International Incorporated. Authorized user: National Bank.

TM ID Check and Identity Check are trademarks of Mastercard International Inc. Authorized user: National Bank.

® Apple Pay is a trademark of Apple Inc., registered in the U.S. and other countries and regions. Apple Inc. is not a sponsor of or participant in National Bank Mobile Banking Solutions.

® Google Pay is a trademark of Google LLC and this content is not endorsed by or affiliated with Google in any way.

1. This coverage applies to purchases charged to the National

Bank MC1 card. Extended warranty coverage applies to most new items

purchased with the card, in Canada or abroad, as long as the

manufacturer's warranty is valid in Canada. Certain conditions and

restrictions apply. For more information and for details of your

insurance coverage, please consult the insurance

certificate associated with your card.

2. Grace period: No interest will be charged on purchases made during the month, provided the client pays the balance in full within twenty-one (21) days of the statement date. This grace period does not apply to cash advances or balance transfers. Minimum payment: If your account balance is lower than $10, you must pay the entire balance. If you reside in the province of Quebec, your minimum payment will correspond to 5% of the credit card account balance plus any overdue payment or $10, whichever amount is higher. If you reside outside of Quebec, your minimum payment represents 2.5% of the credit card account balance plus any overdue payment or $10, whichever amount is higher. Account statement: A statement is sent monthly.

Annual interest rate |

Average balance |

|

|---|---|---|

$500 |

$3,000 |

|

22.49% |

$9.24 |

$55.45 |

20.99% |

$8.63 |

$51.76 |

14.5% |

$5.96 |

$35.75 |

8.9% |

$3.66 |

$21.95 |

*Variable interest rate in effect on September 1, 2021

3. Balance transfers and cash advances are subject to credit approval by National Bank. Each balance transfer must be at least $250.

4. Certain conditions apply. Visit mastercard.ca for more information. Refer to the credit card terms and conditions.

5. Subject to credit approval by National Bank.

6. You will receive a response confirming that your request has been approved, denied, or is in progress. Please note that if your request is in progress, we will ask you for additional information.