To invest please contact your advisor.

NBI Portfolios are investment funds offered by National Bank Investments Inc. (NBI).

They allow you to invest in a full, diverse range of mutual funds.

Minimum initial investment

Minimum purchase/redemption

Minimum systematic investment amount

Do you know your investor profile? Contact us and choose the portfolio that's best for you.

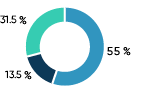

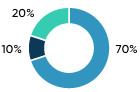

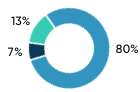

Fixed income

Canadian Equity

Global Equity

Count on our experts for sound investment advice.

To invest please contact your advisor.

As of ${p1.returnProductPricingEffctvDt1Mth | date:"-"}

| Fund name and investment horizon |

Risk |

1 year |

3 years |

5 years |

10 years | Since inception |

|---|---|---|---|---|---|---|

${legacyProductMapping.legacyProductSrcKey,productCriteria.FNDSERIEE.criteriaStringValue,pdfLegacyCode|customLink:"https://nbinvestments.fundata.com/nbi-monthly-profile-$1-$2-Series/pdf$3EN":productName:"_blank"} ${productCharacteristic.fundInvestmentHorizon.stringValue} |

${productCharacteristic.fundVolatility.stringValue} | ${return1Yr} | ${return3Yr} | ${return5Yr} | ${return10Yr} | ${returnScr} |

To invest please contact your advisor.

As of ${p1.returnProductPricingEffctvDt1Mth | date:"-"}

| Fund name and investment horizon |

Risk |

1 year |

3 years |

5 years |

10 years | Since inception |

|---|---|---|---|---|---|---|

| ${p1.productCharacteristic.fundInvestmentHorizon.stringValue} |

${p1.productCharacteristic.fundVolatility.stringValue} | ${p1.return1Yr} | ${p1.return3Yr} | ${p1.return5Yr} | ${p1.return10Yr} | ${p1.returnScr} |

| ${p2.productCharacteristic.fundInvestmentHorizon.stringValue} |

${p2.productCharacteristic.fundVolatility.stringValue} | ${p2.return1Yr} | ${p2.return3Yr} | ${p2.return5Yr} | ${p2.return10Yr} | ${p2.returnScr} |

| ${p3.productCharacteristic.fundInvestmentHorizon.stringValue} |

${p3.productCharacteristic.fundVolatility.stringValue} | ${p3.return1Yr} | ${p3.return3Yr} | ${p3.return5Yr} | ${p3.return10Yr} | ${p3.returnScr} |

| ${p4.productCharacteristic.fundInvestmentHorizon.stringValue} |

${p4.productCharacteristic.fundVolatility.stringValue} | ${p4.return1Yr} | ${p4.return3Yr} | ${p4.return5Yr} | ${p4.return10Yr} | ${p4.returnScr} |

| ${p5.productCharacteristic.fundInvestmentHorizon.stringValue} |

${p5.productCharacteristic.fundVolatility.stringValue} | ${p5.return1Yr} | ${p5.return3Yr} | ${p5.return5Yr} | ${p5.return10Yr} | ${p5.returnScr} |

| ${p6.productCharacteristic.fundInvestmentHorizon.stringValue} |

${p6.productCharacteristic.fundVolatility.stringValue} | ${p6.return1Yr} | ${p6.return3Yr} | ${p6.return5Yr} | ${p6.return10Yr} | ${p6.returnScr} |

Benefit from our open architecture structure which provides us the flexibility to select and review portfolio managers who meet our OP4+ criteria of excellence: organization, people, process, portfolio, performance, and where the + symbol represents environmental, social and governance (ESG) criteria in portfolio management, across all asset classes.

An important pillar in our portfolio manager assessments is the integration of ESG criteria into their investment process. We believe that the consideration of ESG criteria, in conjunction with traditional financial analysis, allows for a better assessment of risks and long-term growth opportunities.

Stay on top of market trends with the quarterly outlook from the experts.

Enjoy lower management fees based on the value of your assets held in certain series of NBI Portfolios—a great reason to group your investment accounts together.

If you have assets with a total net value of at least $100,000 in one or more NBI Portfolios, you will automatically be eligible.

For more information on NBI portfolios, refer to our brochure [PDF].

1. For Investor and R Series securities of all NBI Portfolios and F-2 Series securities of the NBI Balanced Portfolio.

2. The management fee reduction starting from $175,000 is 0.04% for Investor-2 and R-2 Series securities of the NBI Moderate Portfolio and 0.10% for Investor-2 and R-2 Series securities of the NBI Equity Portfolio.

The information and the data supplied on the current page of this site, including those supplied by third parties, are considered accurate at the time of their publication and were obtained from sources which we considered reliable. We reserve the right to modify them without advance notice. This information and data are supplied as informative content only. No representation or guarantee, explicit or implicit, is made as for the exactness, the quality and the complete character of this information and these data. The opinions expressed are not to be construed as solicitation or offer to buy or sell shares mentioned herein and should not be considered as recommendations.

The NBI Portfolios (the “Portfolios”) are offered by National Bank Investments Inc. and sold by National Bank Savings and Investments Inc., separate entities and indirect wholly owned subsidiaries of National Bank of Canada. Commissions, trailing commissions, management fees and expenses all may be associated with mutual fund investments. Please read the prospectus of the Portfolios before investing. The Portfolios’ securities are not insured by the Canada Deposit Insurance Corporation or by any other government deposit insurer. The Portfolios are not guaranteed, their values change frequently and past performance may not be repeated.

The indicated rates of returns are based on the historical annual compounded total returns including changes in securities value and reinvestment of all distributions and do not take into account sales, redemption, distribution or optional charges or income taxes payable by any securityholder that would have reduced returns.

As part of the management fee reduction plan for high net worth investors (the ""reduction plan""), certain investors holding Investor and R Series of all the NBI Portfolios and Investor-2, F-2 and R-2 Series securities of certain NBI Portfolios may be eligible for a management fee reduction based on the size of their investment in one or more of the NBI Portfolios.

The reduction plan only applies to the series of the NBI Portfolios that are eligible. The amount equivalent to the management fee reduction takes the form of a distribution, which is automatically reinvested in additional securities of the same series of the applicable NBI Portfolio. For more information about the reduction plan, please see the NBI Portfolios prospectus.

The cash distribution amount per unit for the R Series and the R-2 Series of NBI Portfolios is said to be fixed as it does not vary from one distribution to another. However, it is not guaranteed and may vary according to market conditions. R Series units and R-2 Series units of the NBI Portfolios pay monthly distributions made up of net income and may include a significant portion of return of capital. Return of capital actually decreases the value of your initial investment and must not be confused with return on investment. Return of capital that is not reinvested can reduce the net asset value of the fund and may lessen its ability to subsequently generate income. The monthly distribution amount per unit is reset at the start of each calendar year.

® NATIONAL BANK INVESTMENTS is a registered trademark of National Bank of Canada, used under licence by National Bank Investments Inc.

National Bank Investments is a signatory of the United Nations-supported Principles for Responsible Investment, a member of Canada’s Responsible Investment Association, and a founding participant in the Climate Engagement Canada initiative.

Take advantage of a safe investment with guaranteed returns.

Talk to one of our experts to get tailored investment advice.

1-888-270-3941

Monday to Thursday,

8 a.m. to 6 p.m. (ET)

Friday, 8 a.m. to 5 p.m. (ET)