Leverage the potential of sustainable Canadian companies

Canadian Market-Linked GICs allow you to benefit from the growth potential of sustainable Canadian companies, with 100% principal protection at maturity. The Reference Index is comprised of 60 Canadian companies in a variety of industries. The reference portfolio is comprised of 20 securities selected using a selection methodology based on exclusion criteria as well as the selection of leaders in risk management.

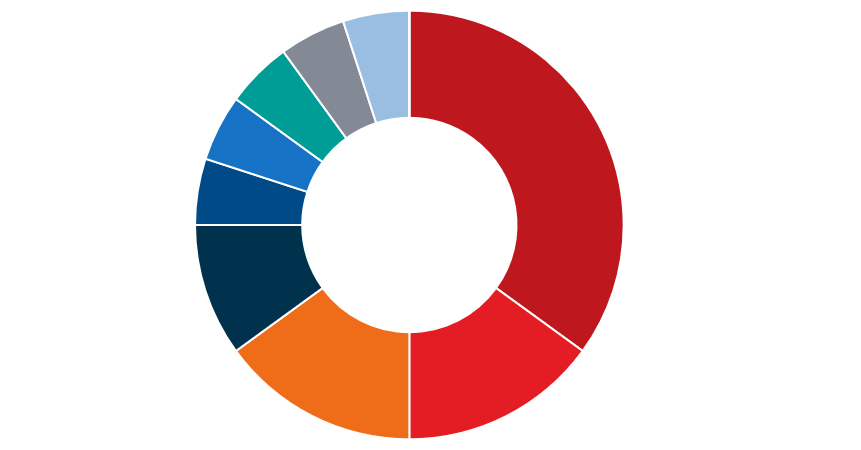

Financials

35%

Communication Services

15%

Consumer Discretionary

15%

Utilities

10%

Consumer Staples

5%

Industrials

5%

Materials

5%

Real Estate

5%

Information Technology

5%

* Bloomberg March 2023

Our advisors can help you choose the GIC that's right for you.

Ideal for those who want to enjoy increasing interest rate tiers while keeping their funds accessible.

Ideal for short-term investments by using low-risk funds that are easily transferable.

Ideal for putting money aside while also being able to immediately access your funds in case of unexpected events.

The Canadian Sustainable Companies GIC (the “MLGIC”) aims to provide you with a return linked to the price return performance of the common shares or the units of the 20 Canadian sustainable companies (the “Reference Shares”) specified in the relevant Information Statement. These Reference Shares are selected in accordance with the methodology set forth in the Information Statement. Investors of the MLGIC will be entitled to receive on the Maturity Date repayment of the principal invested on the Issue Date and a Variable Interest, depending on the performance of the Reference Portfolio over the term of the MLGIC. No interest or any other amount will be paid during the term of the MLGIC. The Variable Interest is calculated as follows:

The Reference Portfolio Return used in the Variable Return calculation corresponds to the arithmetic average of the Reference Share Return of each of the Reference Shares comprising the Reference Portfolio. Such Reference Share Return is based on the average of three Reference Share Prices of each Reference Share determined over the last three months of the term of the MLGIC. The Reference Share Return will not take into account dividends and/or distributions paid by the issuers on account of each of the Reference Shares.

Complete information for a specific series of MLGIC is available in the relevant Information Statement and it should be consulted before investing. Please refer to the rates bulletin to consult the series issued by National Bank of Canada. You may also find information herein, by contacting your branch advisor or by calling 1-888-483-5628.

The MLGIC is a deposit eligible for deposit insurance by the Canada Deposit Insurance Corporation (“CDIC”), subject to the maximum dollar limit of CDIC coverage and applicable conditions (www.cdic.ca). The MLGIC is not a conventional fixed income investment, is not suitable for all types of investors and is subject to several risk factors. Capitalized terms used and not otherwise defined herein have the meaning ascribed thereto in the Information Statement.

Talk to an advisor for personalized advice or choose an investment online.