Live your new life to the fullest

Whether you’re dreaming of an action-packed retirement or just looking forward to some rest and relaxation, careful planning will let you look to the future with peace of mind. Planning for retirement isn’t as difficult as you think. The key is to have an accurate picture of your financial situation and a clear vision of what your dream retirement looks like.

Make the most of the freedom of retirement! Let an advisor guide you through each step of the planning process.

It’s the million-dollar question. You’ve been saving for years, but is it enough?

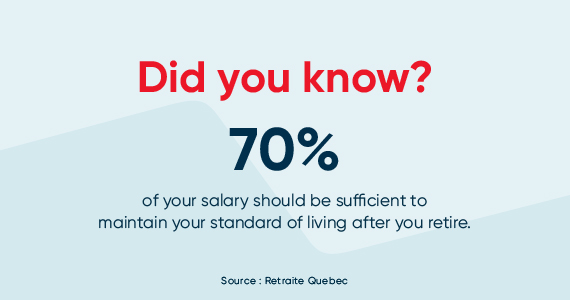

As a general rule, you’ll need the equivalent of 70% of your gross annual income to maintain your standard of living after you retire. That said, every case is unique. Your advisor can help you determine your personal requirements by looking at your life goals.

Do you want to stop working before age 65? You’ll need to maximize your savings during your working life.

If you enjoy your job, perhaps you’d prefer to go part-time or continue working for another 10 years or so before slowing down? In this case, your salary will help maintain your lifestyle.

Think carefully about what you want your new life to look like. This will help you determine what your financial needs will be.

Don’t underestimate your expenses, especially medical costs. Healthcare needs often increase with age, and you may no longer be eligible under your employer’s plan or other insurance policies.

Remember, too, that the public prescription drug insurance plan offers less coverage than most private plans.

If your house is costly to maintain or feels too big now that your children have flown the nest, consider downsizing to a less expensive home to help maintain your standard of living.

Has your home appreciated in value over the years? You could take advantage of this increased value to finance new projects with a home equity line of credit, or you might choose to sell your home and invest the proceeds.

You may be eligible for government programs that provide a basic retirement income. Think strategically: the older you are when you take your pension, the higher your benefits may be.

Do you have a pension fund or a company pension plan? This will provide an additional source of income in retirement.

Sit down with your advisor and make a list of all your potential sources of retirement income, then draw up a budget that leaves some wiggle room for treats and unexpected expenses.

Even after you’ve retired, you can continue contributing to your RRSP until December 31 of the year you turn 71. Beyond this point, provided that your spouse hasn’t yet turned 71, you can reduce your taxable income by making contributions to their RRSP.

TFSAs are another great way to save. There are no age limits and withdrawals are tax-free, so they won’t impact your eligibility for government programs like the Guaranteed Income Supplement.

Get more information by email

Sign up for our newsletter to get the latest offers and advice to power your ideas.

Tell me more!

Meet with an advisor to get tailored advice.