*Certain products require a minimum amount for systematic savings, as follows: Cash Advantage Solution for registered plans (RRSP, TFSA, FHSA, and non-registered accounts) requires a minimum of $10; NBI Portfolios require a minimum of $25. There is no minimum amount required for systematic savings via the transfer function to a High Interest Savings account. Savings frequency can be tailored to your needs. Some products, such as GICs, do not support systematic savings. Conditions apply. For further information, please schedule an appointment with an advisor.

At a glance

What is a systematic savings plan?

Saving has never been easier! Just set up automatic transfers from your bank account. Think of it as a bill payment. The money can be deposited in a savings account, RRSP, RESP, TFSA or FHSA or non-registered account.

Perfect if you are looking to:

- Save for a trip

- Build a retirement fund

- Buy or renovate a home

- Set aside an emergency fund

How do systematic savings work?

Systematic saving isn't anything complicated: it's simply putting aside a certain amount* of money at set frequencies. The first step is to define your project to determine how much money you need to make it happen.

Do you want to create an emergency fund to better prepare for the unexpected? Saving for your next vacation? For this type of short-term project, you could open a High-Interest Savings Account online and make payments at the desired frequency.

Are you saving for a long-term project like buying a home or retirement? Talk to us about it. Together, we can find the right investment solution for you and determine how much you need to save to reach your goal.

Set up your systematic savings account

To set up your systematic savings in your savings account

- Sign in to your online bank

- Click Transfer to set up systematic savings.

- Select the amount and frequency of your choice.

- Feel free to make changes at any time.

Set up your recurring purchases in your investment account

'You can set up recurring purchases in your FHSA, TFSA, RRSP, RESP or non-registered account.

- Sign in to your online bank.

- Click on Overview in the menu on the left.

- Select your investment account.

- Select the Recurring Purchases tab, and then click on Add recurring purchase.

- Review your investor profile and enter the information for your recurring purchases.

Make saving easy—set up a systematic savings plan today!

Not a client yet? Make an appointment with an advisor.

5 great reasons to set up systematic savings

- Profitable: The earlier you start, the more you'll save

- Accessible: It's easier to make small, regular investments than set aside a large amount all at once

- Simple: Just set up automatic withdrawals

- Convenient: Select the frequency and amount you want

- It's prudent: for your investments, when you save small amounts at a time, your money is better protected against market volatility

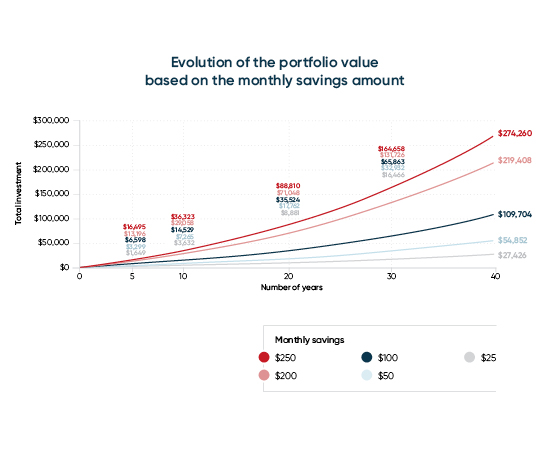

Small investments can really add up!

An investment that pays off

Over time, the money you save will grow.

It may not seem like much, but you can end up with a considerable nest egg by making regular small investments.

Little details that matter

Need some advice?

Talk to one of our experts to get tailored savings advice.