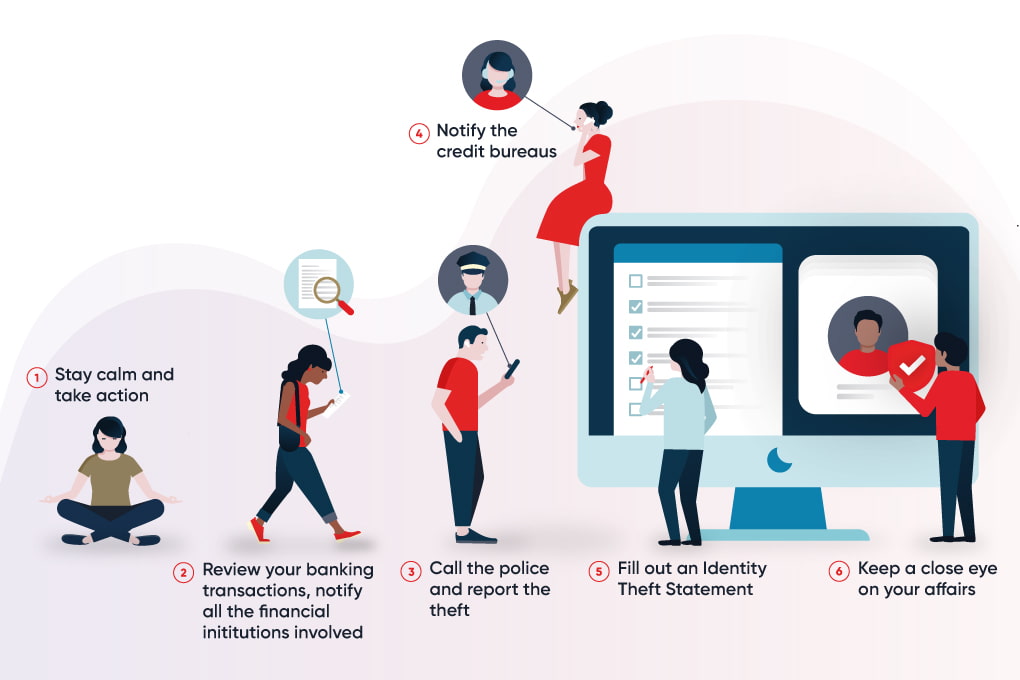

1. Stay calm and take action

Once you’ve established that your identity has been stolen, try not to panic. You’ve got a lot to do, and it’s important to be methodical. Write down every detail from the enquiries you make:

- Names of institutions and people contacted

- Date and time

- Information received

- Confirmation numbers

Check whether you have access to an identity theft assistance service or whether your home insurance policy includes protection against identity theft – many policies will provide assistance or even legal aid. Certain legal fees and costs incurred in restoring your identity may also be reimbursed.

2. Check your banking transactions

Check all your bank account and credit card transactions to identify suspicious activity. Notify ALL your financial institutions. If an account has been affected, the institution will tell you how to replace your cards, secure your account and, depending on the situation, whether a refund is possible.

Take this opportunity to change the PIN (personal identification number) on all your cards, as well as your email, social media and online banking passwords, as they’re often similar to one another. Never use the combination “12345.”

To learn more

Here

are some articles with helpful tips on how to prevent online fraud:

→ How

can you protect yourself against bank fraud?

→ Phishing:

How to recognize fraudulent communications

→ How

to create a strong password

3. Contact the police

Filing a complaint could help you prove that the transactions made in your name are fraudulent (and could help catch those responsible).

4. Notify the credit bureaus

The next step is to notify the credit bureaus Equifax and TransUnion that you’ve been a victim of identity theft. They’ll add a “fraud alert” to your file so that any institution that receives a credit application in your name will have to contact you by phone to make sure you’re the one who made the request.

You can also ask for a copy of your file to see your most recent credit applications.

5. Fill out an official form

File a complaint with the Canadian Anti-Fraud Centre.

If you’ve had identity documents such as your passport or driver’s licence stolen, contact the appropriate government authority to notify them, then follow their instructions.

6. Keep your eyes open

Once you’ve taken all the necessary steps, keep an eye on your finances: it’s easier to detect suspicious transactions in your account than it is to know whether someone applied for social assistance in your name in order to falsely receive your benefits.

Read your mail carefully, even when it comes from institutions you don’t have any accounts with. If someone is using your name, a letter could be the first clue. This is also where the “fraud alert” set up with the credit bureaus comes in handy: you’ll be contacted for each new application in your name.

Additional tips to protect yourself from identity theft

It’s certainly more pleasant to manage extra money than it is the consequences of identity theft. To avoid falling victim to the latter, here are some other precautions that can reduce the risk of fraud:

- Never send personal information by email or text message (access codes, PINs, phone numbers, social insurance numbers, etc.)

- Only open attachments from people you trust: they could contain a virus that enables others to access information on your computer or phone.

- Before giving out any personal information, ask yourself if you really know the identity of the person you’re giving it to. Also consider whether it’s really necessary: there’s no reason to give out your social insurance number for an apartment lease, for example.

- Be vigilant on social media: indicating your date of birth on Facebook may get you tons of birthday messages, but it’s also useful information for scammers. Avoid posting it, at least in its entirety. And though it may seem obvious, a photo of your passport announcing your upcoming trip to the Caribbean is a definite no. If you haven’t already done so, change your settings so that your profile is only visible to people you know, rather than to anyone online.

- If you need to provide confidential information, do so by phone (by calling the number yourself) rather than by email. The less paperwork, the better.

- Only carry the cards you really need: you’ll have fewer documents to replace if your wallet is lost or stolen. And keep it with you when you go out. It’s more likely to be stolen if it’s in your coat that’s hanging on a chair in a restaurant, for example.

- Before you throw away your expired ID or credit cards, cut them into several small pieces (not just two). Shred or tear up your personal mail as well: the idea is to make it difficult for anyone to get their hands on any sensitive information. Attaching a lock to your mailbox to prevent anyone from going through it can also be a good idea.

- And make sure your phone can only be unlocked with a code – it’s a treasure trove of personal information. Enable biometric unlocking (fingerprint or facial recognition) if possible.

There are many additional measures you can take to protect yourself.

Want to learn more? Our fraud prevention page will provide you with a wealth of useful information.