What is market volatility?

Volatility is the return or value of a security measured over a period of time compared to the average. Why is a high volatility stock considered risky? Because rapid fluctuations in value make it more difficult to predict the resale price at which you would see a gain.

How is market volatility defined?

When talking about volatility in the stock markets, we mean that there are big swings in the prices of listed securities and stock market indexes. In times of strong volatility, markets are said to be unstable.

What causes market volatility?

Volatility is influenced by several factors. Here are some of the causes that can lead to significant market movements:

- Inflation

- Rising interest rates

- A recession

- Geopolitical conflicts

- Trade and supply chain conditions

Volatility can occur even before one of these events takes place. For example, stock markets can become volatile a few months before a recession hits. In this case, prices reflect the uncertainty associated with the risks of a recession.

While it can be a source of stress for investors, keep in mind that market volatility is generally a fleeting phenomenon.

To learn more about the stock market:

What should you do in times of market volatility?

Stay focused on your financial goals

First and foremost, don’t panic, and don’t make any haste decisions! On the contrary, this is the time to stay the course. It’s normal for the different asset classes to fluctuate over time. However, in the long run, they tend to move in a positive direction.

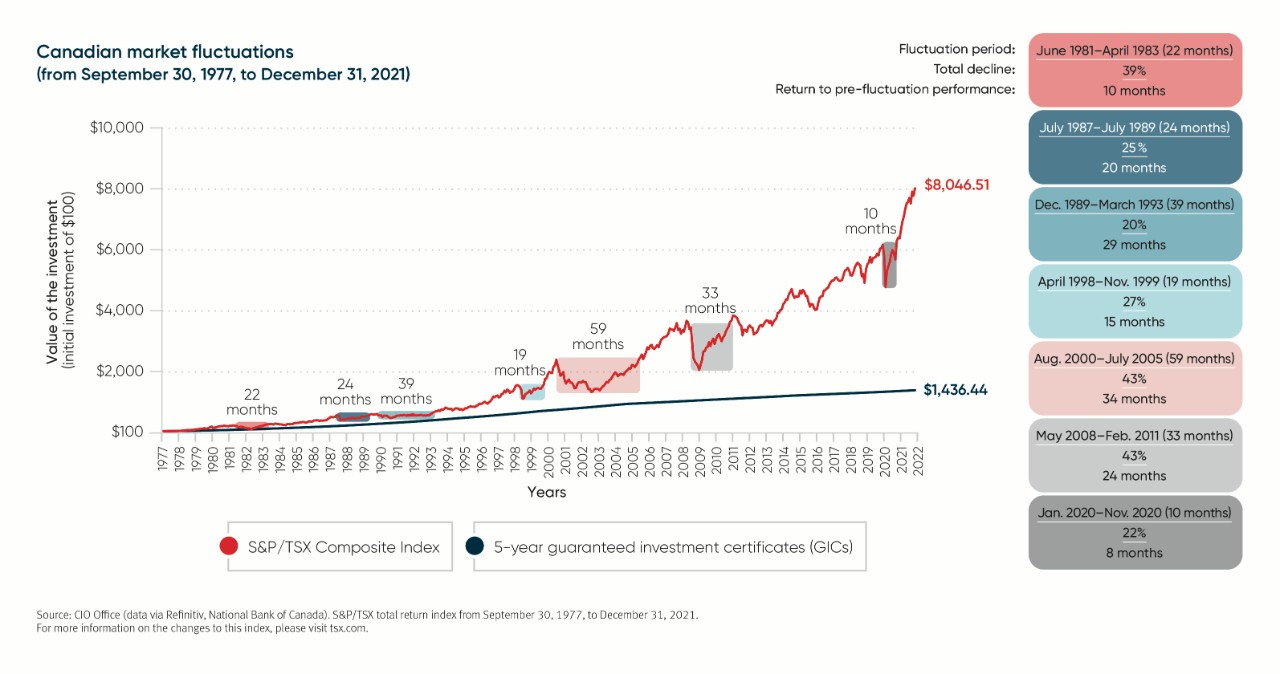

The chart below shows the S&P/TSX Composite Index, which measures the performance of the Toronto Stock Exchange, from September 30, 1977, to December 31, 2021. It shows that each period of downward volatility has been followed by an upward trend.

That’s why it’s important to stick to your goals and give your investments time to perform. If you’re thinking of changing your strategy, talk to your financial advisor, who will analyze possible scenarios with you.

What strategy can help you reduce portfolio volatility?

Diversify your portfolio

Your investment strategy should always reflect your investor profile and financial goals. That said, remember that diversifying your portfolio may help protect you from stock market fluctuation.

What is diversification exactly? Even if markets and some indexes have declined, not all securities will necessarily follow suit. This is because there are many different types of asset classes from different sectors and regions. They will not all be affected by the same events or to the same degree.

In other words, when you diversify your investments, the part of your portfolio that is performing well could offset the part that is not.

Tip!

Bonds are generally less volatile

than stocks. In times of volatility, if you have bonds in your

portfolio, your assets will decline less than if you held only

stocks in your portfolio.

Keep in mind that it’s possible to diversify both the individual securities and the funds in which you invest. Many investment funds offer diversified portfolios, which is an interesting feature to consider.

Good to know: Don’t confuse diversification with spreading

similar investments over several financial institutions. This

practice does not offer any advantages and, worse, could even cost

you more in fees.

To learn more about the different asset classes:

→ Consult our guide to types of investment.

Is it a good time to start investing when markets are down?

If you’re new to investing, a period of market fluctuation can be an opportune moment to take your first steps in the stock market. While it’s always a good time to invest, when markets are volatile and stock prices have declined, you will be able to buy assets at a lower cost that may grow over the long term.

This advice also holds true if you have been investing for a while. A period of volatility will give you access to stocks at a lower cost than usual.

Remember, in times of instability and volatility, the key is to stay calm. If you let your emotions guide your decisions and pull out of the market during a downturn, chances are you’ll end up taking a financial loss. That’s why it’s best to be patient and stay focused on your goals while continuing to save. If you’re still worried, meet with an advisor who can review your strategy with you.

Would you like to discuss this with us? Contact your National Bank advisor or your wealth advisor at National Bank Financial to learn more. Don’t have a specialist in charge of your file?