- You asked: “How do I save for my studies?”

♪♪

I’ll explain faster than I can make a 3-cheese pizza.

- Oh... we only have one.

- Fine, a 1-cheese pizza.

Getting a good education is a big deal, but it also comes with big expenses.

Tuition fees

Books

Cellphone and laptop

Transportation

Are you going to live at home or on campus?

And what are you going to eat?

Because I don’t suggest an all-ramen diet.

- Hey! I’m making a pizza over here.

- Right.

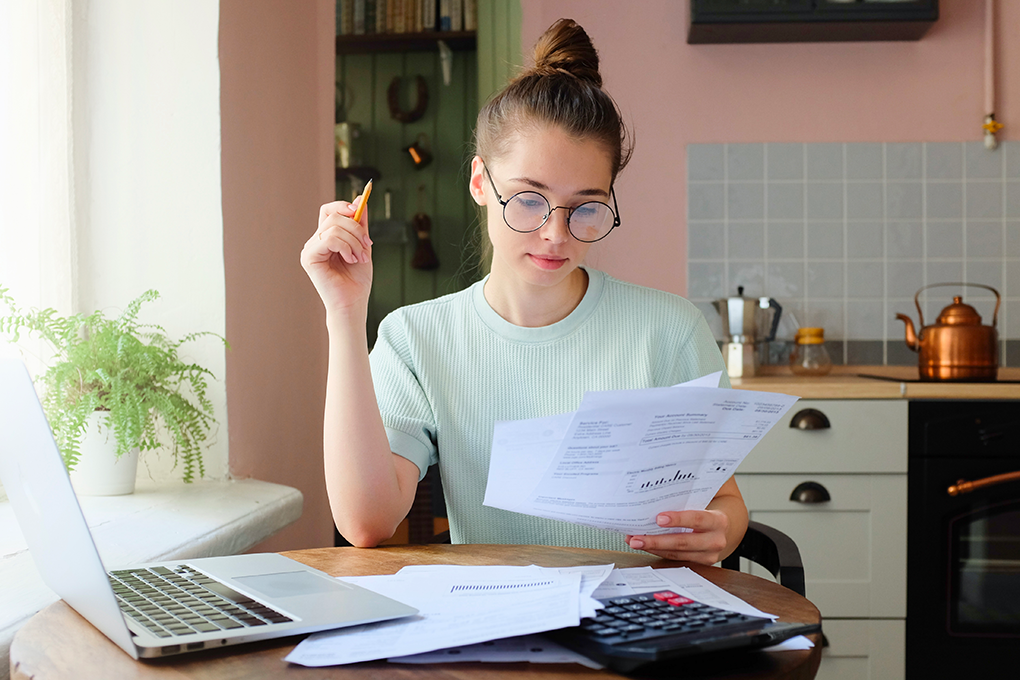

A lot of people ask themselves how they’re going to pay for all that.

Ask your parents if they’ve put any money aside in a college fund.

If not, they might lend you a hand anyway.

Cause you’re a good kid!

Another option:

The government offers financial aid to students.

Also known as loans and bursaries.

The loans come at a very low-interest rate, that you repay after your studies.

Bursaries don’t need to be repaid at all.

A student line of credit can be flexible.

- Like mozzarella!

- Right. You start with a pre-determined line of credit, at a rate substantially lower than a credit card, that’s recalculated every year.

You determine how much you borrow and the rate at which you’ll pay it back.

But remember, you’re responsible for your monthly interest payments and you’ll have to start repaying the credit line 12 months after you graduate.

Pi-pi-pizza

Finally, my 3-cheese pizza.

- You got delivery?

- You don’t have an oven.

- Oh, yeah.